Select company website

You are currently visiting: EFG Documentation

EFG Access

Introduction to EFG access

The EFG Access mobile app can now be used to verify requests from your eBanking accounts, quickly and securely, enabling actions to be executed. The request can be to confirm external payments, provide double signatures and authenticate client identity.

Eligible users

Validation of payments

EFG Access is designed for EFG clients with European and Asian accounts. The application is fully compliant with European directive PSD2 and meets the strict client-authentication requirements that were implemented on 14 September 2019.

Support identification

EFG Access can be used by all clients calling our support line to verify their identity when they call our eBanking support team.

Using EFG Access

Important information

In line with the European Payment Service Directive (PSD2), all European banks are required to secure electronic payments with a strong client authentication. All the electronic payments debited from European accounts must comply with this directive. This means that all clients making a payment that will be debited from a European account must use the EFG Access application to validate the payment. The option to validate payments using the Entrust token will no longer be available for accounts booked in one of EFG’s European locations.

Main features of EFG Access

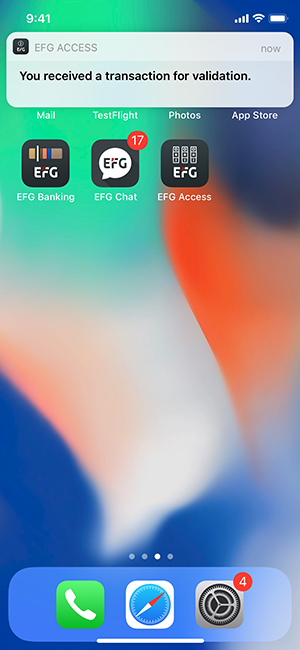

- Push notifications

Every time you want to validate a payment to an external recipient using your EFG eBanking, you will automatically receive a push notification on your mobile device. You will be able to click on the notification to launch the EFG Access application and validate the request.

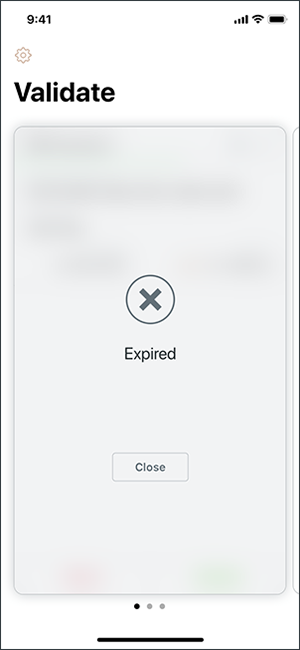

- Lifetime

Once you have received the validation request on your mobile device, you will have 90 seconds to validate it using the EFG Access application. After 90 seconds, the request will expire a new request must be triggered.

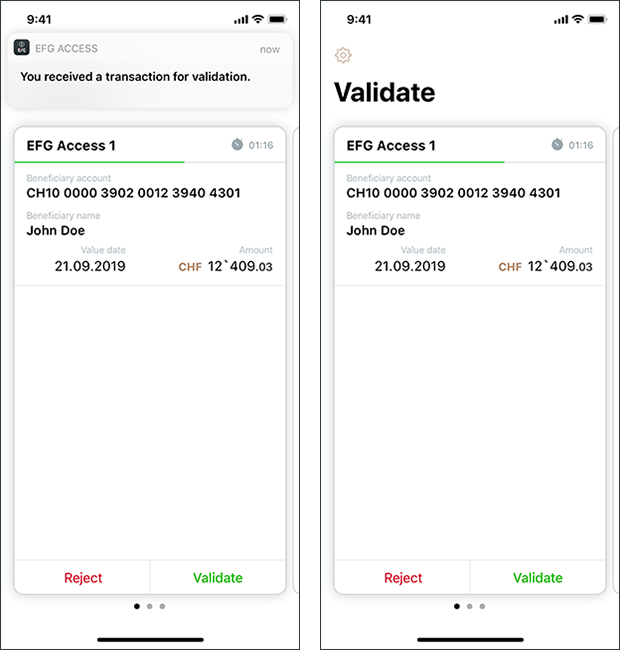

- Checking payments before validation

Once you have opened the EFG Access application on your device, if a push notification has been received, you will see an overview of all the payments awaiting validation.

Each payment (or group of payments) is displayed in a single panel. If there are multiple payments (or groups of payments), you will be able to navigate between the panels by swiping left or right. For a group of payments, you can scroll down within the panel to see each individual payment

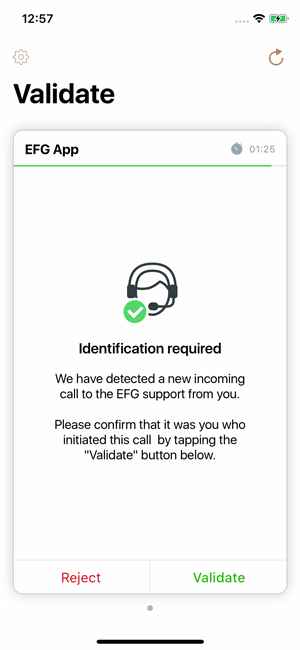

- Checking an identification request

When you call the eBanking support team, you will need to identify yourself. With EFG Access, this is easy. The eBanking support member will send an identification request that will appear on EFG Access, as shown below. To ensure security, no personal information will be displayed.

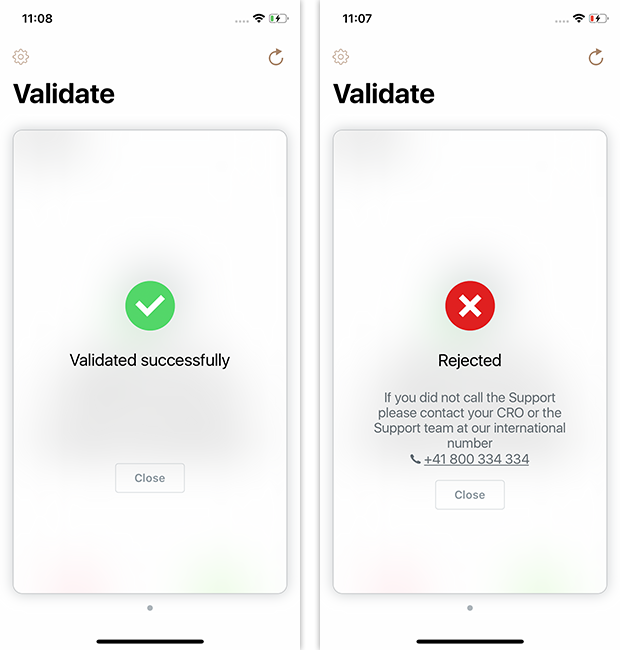

- Validate or reject a request

The EFG Access application allows you to validate or reject the request(s), quickly and easily, with a single tap. Once the request has been validated/rejected, the appropriate action will be taken. When all outstanding requests have been validated/rejected, the Validate screen will provide notification, as shown in the final screen below.