Select company website

You are currently visiting: EFG Documentation

EFG Mobile Banking

Introduction to the EFG Banking app

EFG Banking (our mobile banking application) offers clients an easy way to access their accounts. It allows them to check their portfolios and verify their most recent transactions, all from their mobile phone. It also enables them to keep up to date with their portfolio distribution. The newest version of the app allows Swiss clients to make orange-slip and QR Bill payments with a newly incorporated scan tool.

Clients can use the new version of the app to check on payments they have made (including those entered through the browser-based EFG eBanking system) and manage their list of confirmed beneficiaries.Please note that the current version of the EFG Banking app does not allow the execution of double-signature payments. These must be processed using our browser-based eBanking system.

Use EFG Mobile Banking

EFG Mobile Banking is designed to assist EFG clients in their banking activities wherever they are.

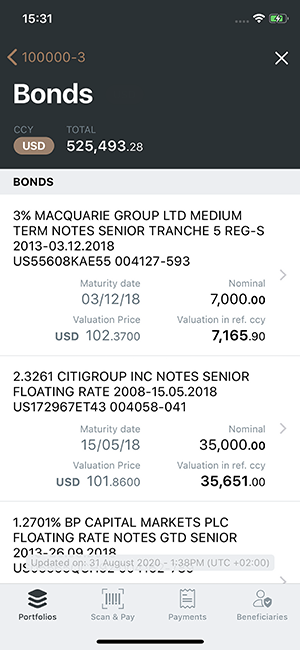

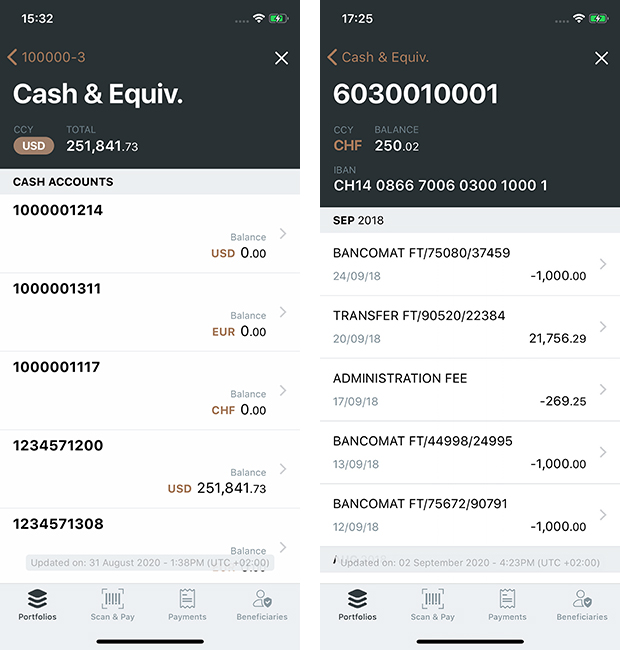

The current version of EFG Mobile Banking only shows all positions held within your portfolio as well as all cash transactions that have been executed.

All the data displayed on the EFG Mobile Banking is live data retrieved from the core banking system.

Please bear in mind that since this is a preliminary version of the EFG Mobile Banking there are some restrictions:

-

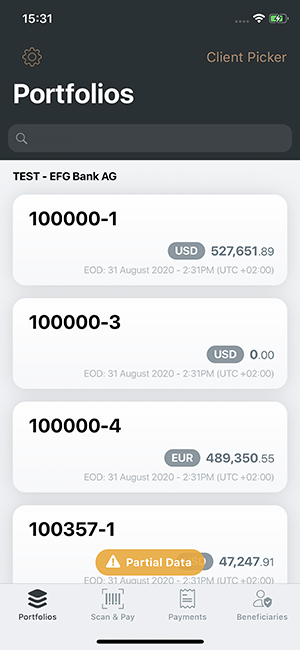

On the list of portfolios, each portfolio displays the end of day valuation; it is necessary to open the portfolio in order to get the real-time valuation.

-

It is only possible to refresh the data displayed on the list of portfolios and on the portfolio overview screen.

Main features of EFG Mobile Banking

-

Consult the list of portfolios.

-

Client picker is available also in the mobile version to help selecting the portfolios among the list of entities one might have. Please note that if you want to see other entities displayed in this list you can check with your CRO.

-

-

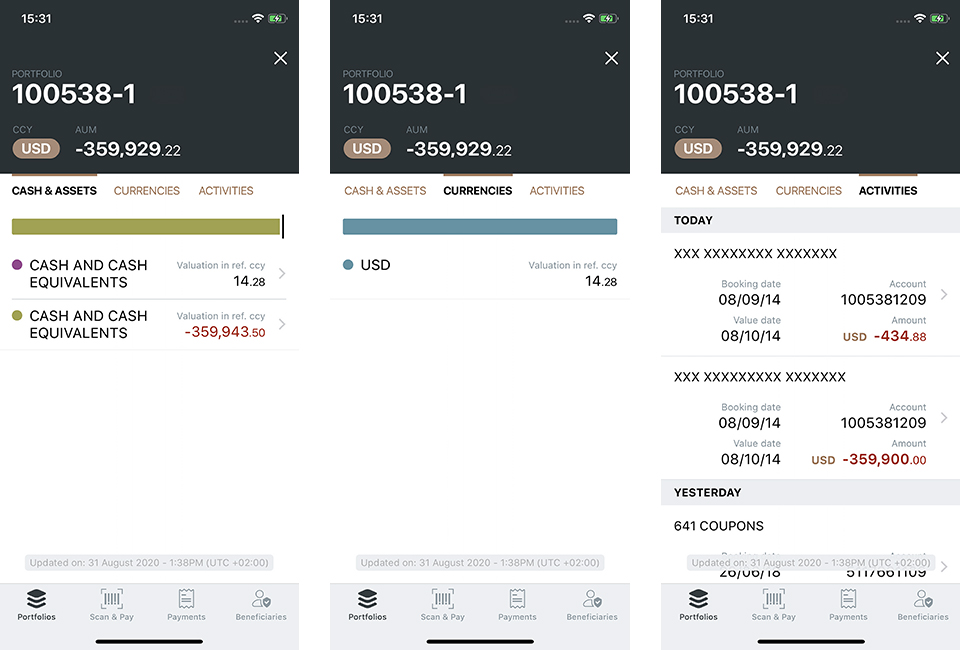

Drill down a portfolio to check the portfolio distribution in terms of assets, currency and activities.

-

Get the details on the assets held in a portfolio.

-

Consult the last transactions executed in one account.

Payments

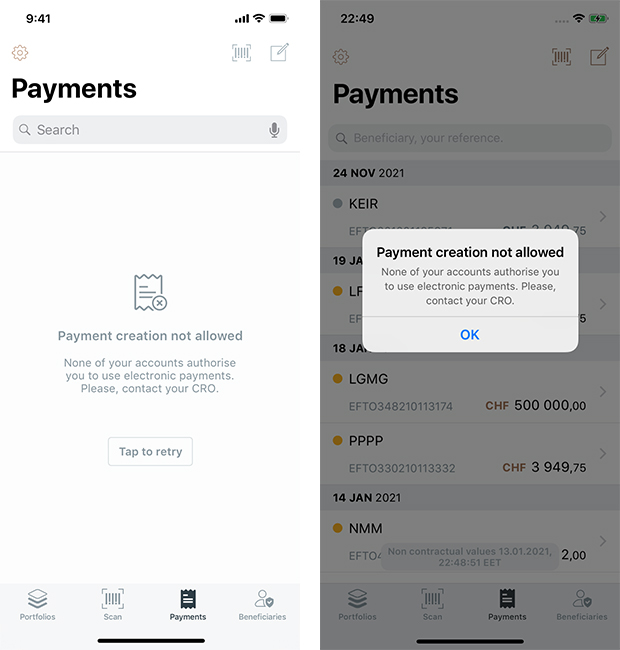

Our mobile payments solution (orange payment slip and QR Bill processing) is currently available to our Swiss clients only. Other features, such as access to the lists of recent payments and confirmed beneficiaries are available to all clients.

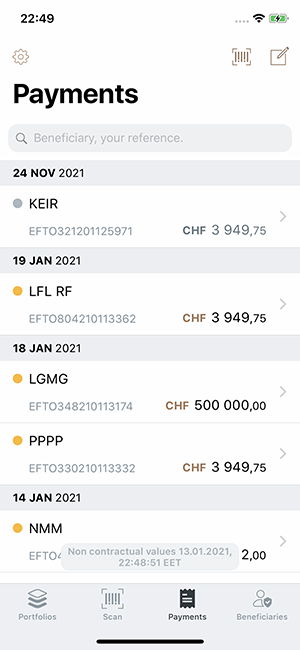

List of payments:

You can consult the list of executed payments either via the browser-based eBanking system or using the EFG Banking mobile app. The list of payments shows live information and the EFG Banking app allows it to be updated at any time.

Note: the list of payments is sorted by value date.

The ‘payments’ screen allows you to access a list of your most recent payments. You can search the payments, filtering by:

- Status

- Debit account

- Value date

Alongside executed transactions, the payment list also displays “drafted” payments. These are payments that have been initiated but not yet completed. If you pause half way through setting up a payment, you can return to your draft and continue editing at any time by selecting it from the list.

You can tap on any of the orange or QR Bill payments on this screen to see full details of the trans-action (*)

(*) Please note that this functionality is available for orange-slip and QR Bill payments and Swiss cli-ents only. The payment facility will soon be expanded to include other features, such as internal and external payments.

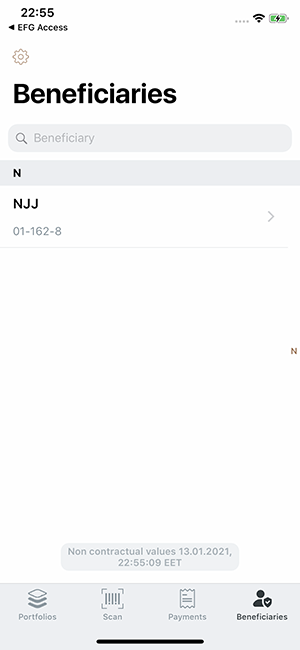

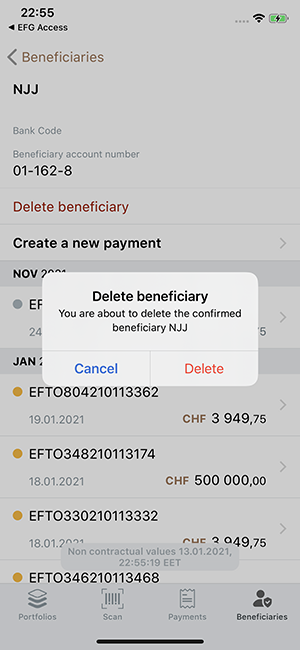

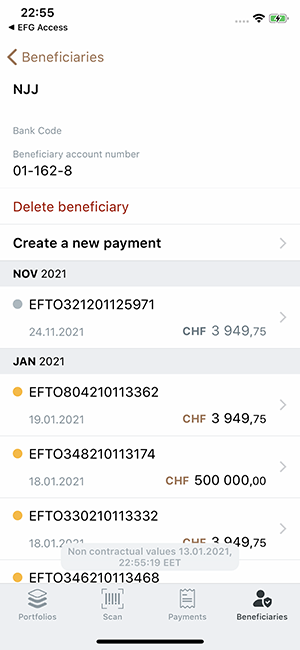

List of beneficiaries:

Swiss clients can add or remove confirmed beneficiaries and also consult the list of payments made to those on the list.

1. Remove a beneficiary from the list.

2. Make a payment to a confirmed beneficiary (Swiss clients only).

3. Check the list of payments made to confirmed beneficiaries.

Orange payments and QR Bill payments

Please note that the current version of the EFG Banking app, does not allow payments that require double signatures. This type of payment can be executed via the browser-based eBanking system.

Swiss clients experiencing difficulty entering orange payment slips or QR Bill payments should con-tact their CRO for assistance.

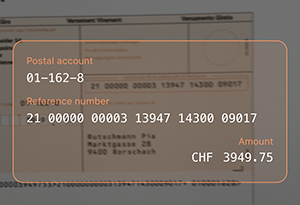

Orange payment slips can now be entered using a scan function. It has never been so easy.

Payments can be revised or cancelled at any stage prior to completion. “Draft” payments will be displayed on the list of payments and you can resume editing at any time.

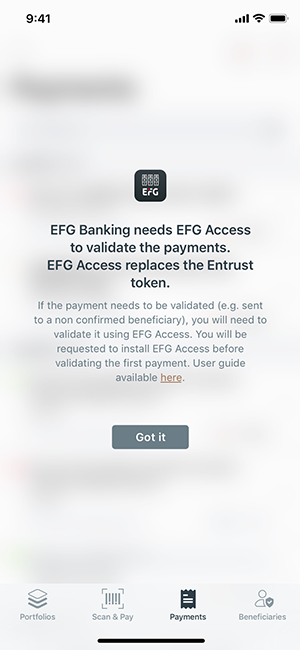

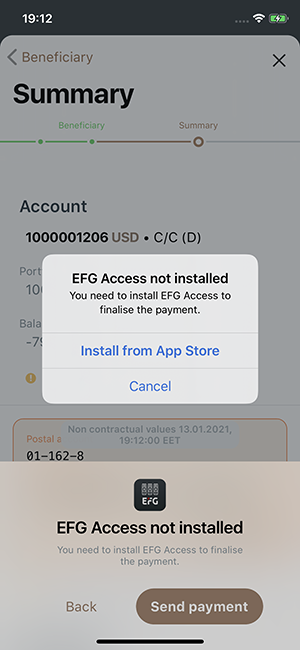

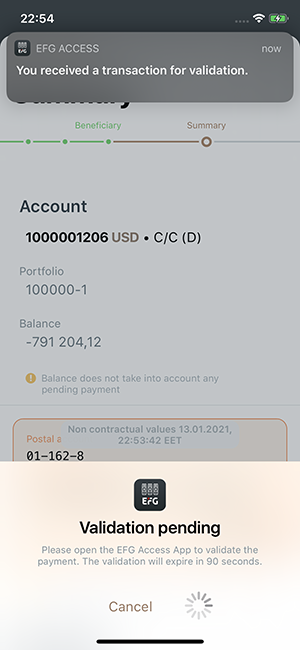

EFG Banking uses the EFG Access app for payments validation (user guide available on https://doc.efgbank.com/Mobile/App-guide/EFG-Access.html ). This app replaces the Entrust token used in the browser-based eBanking Payments application. If your EFG Banking app payment needs to be validated (e.g., if it is being sent to a non-confirmed beneficiary), you will be requested to do this via the EFG Access app. If you have yet to install this app, you will receive a request to do so when you set up your first payment using the EFG Banking app. EFG Access is available to download on Android and iOS.

Scan tool

EFG Banking App allows you to set up orange payment slip or QR Bill processing by scanning the slip and entering three short pieces of information:

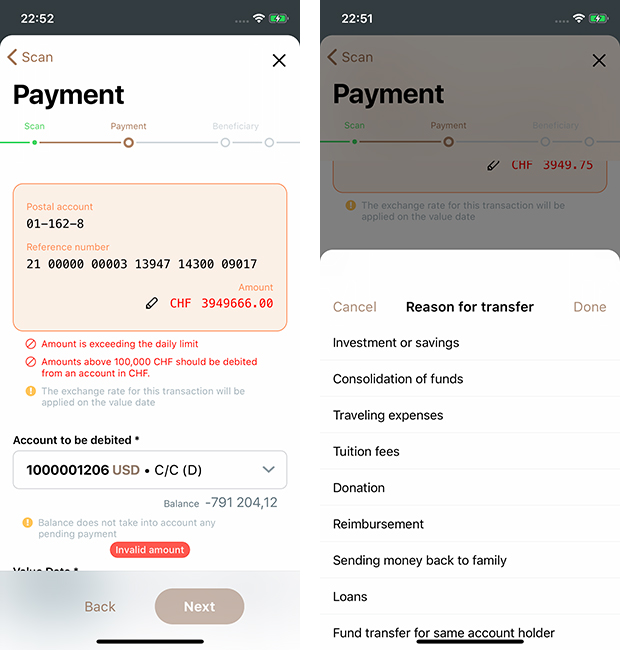

- Payment data:

- Debit account (required)

- Value date (required)

- Your reference or comment to CRO (optional)

Checks are performed to ensure that the value of the payment does not exceed available fund. If this is not the case, or if an invalid value date has been entered, an error message will appear:

- Reason for transfer.

- New amount dialog.

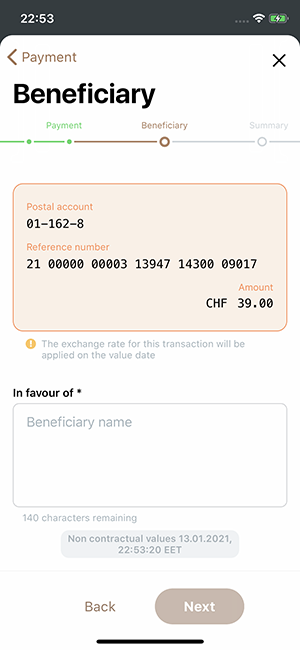

- Beneficiary’s information:

The information about the beneficiary, as written on the orange payment slip should be entered here.

This information is scanned and displayed on the screen for the QR Bill payments.

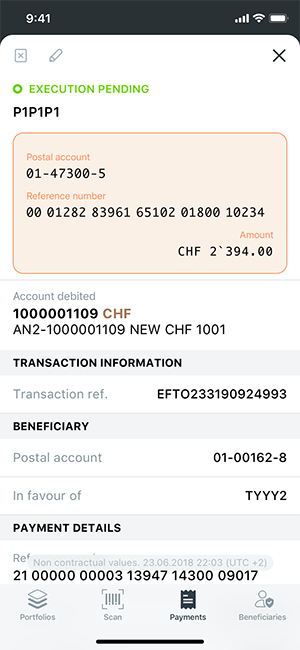

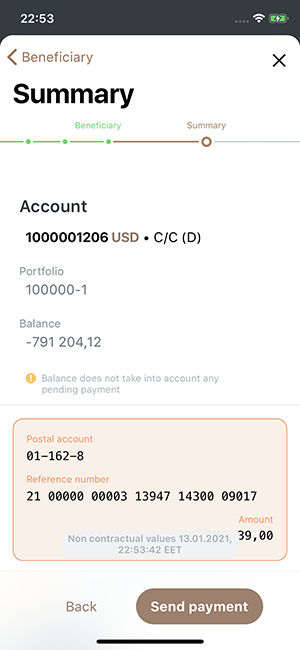

- Summary

On this screen you can review the data you have entered, go back and correct any errors, or send the payment for execution or signature. If necessary, you can save the payment as a draft, or cancel it completely.

If you need to confirm the beneficiary and you have yet to install EFG Access, you will not be able to proceed. The process will be blocked and you will be prompted to install the EFG Access app.

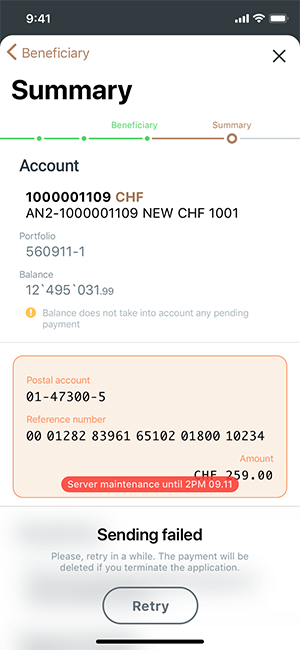

In case of any issue raised after you send the payment, we will inform you with an error message.

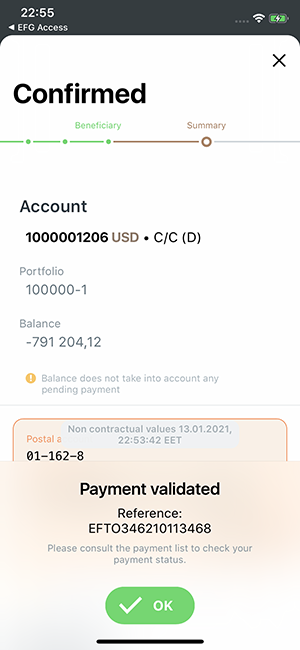

Where necessary, you will be asked to validate payments via EFG Access:

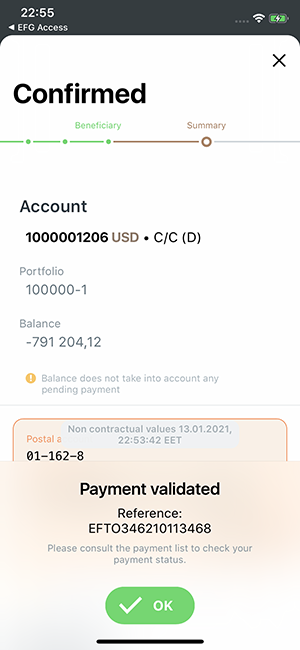

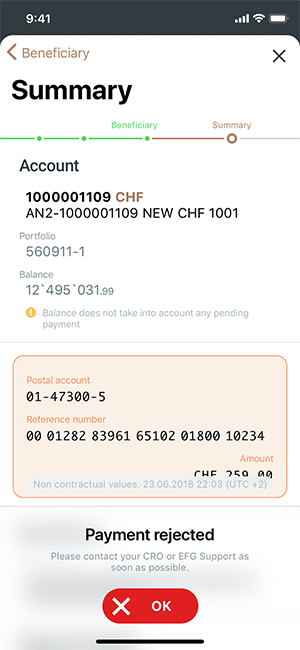

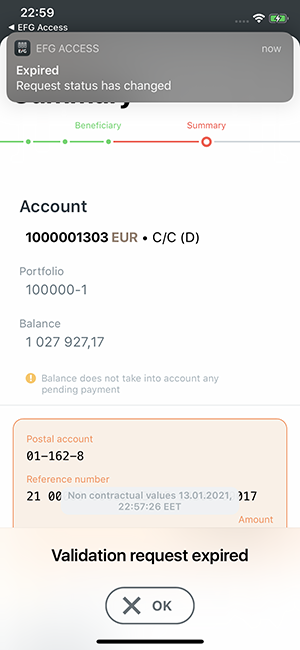

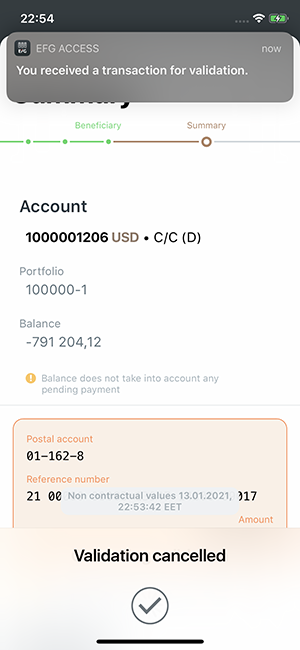

- Payment sent for validation. You will have 90 seconds to validate the payment via the EFG Access app.

- Payment validated.

- Payment rejected.

- Payment validation expired.

You can cancel the validation request at any time.

If payment validation was rejected, cancelled, or expired, you will remain on the “Summary” page when the information pop-up disappears. You can repeat to process from this screen.

- Confirmation

After the payment is sent (and validated as necessary) you will see the confirmation screen where you can find the reference of this payment.

When you close this screen, you will be redirected to the list of payments. Here, you will see the payment you have just entered.